Tesla to Open First-Ever India Showroom in Mumbai on July 15 – Game-Changer for EV Market in 2025

Tesla is set to open its first-ever showroom in India on July 15, 2025, in Mumbai—marking a major milestone in the country’s fast-growing $3 billion EV market

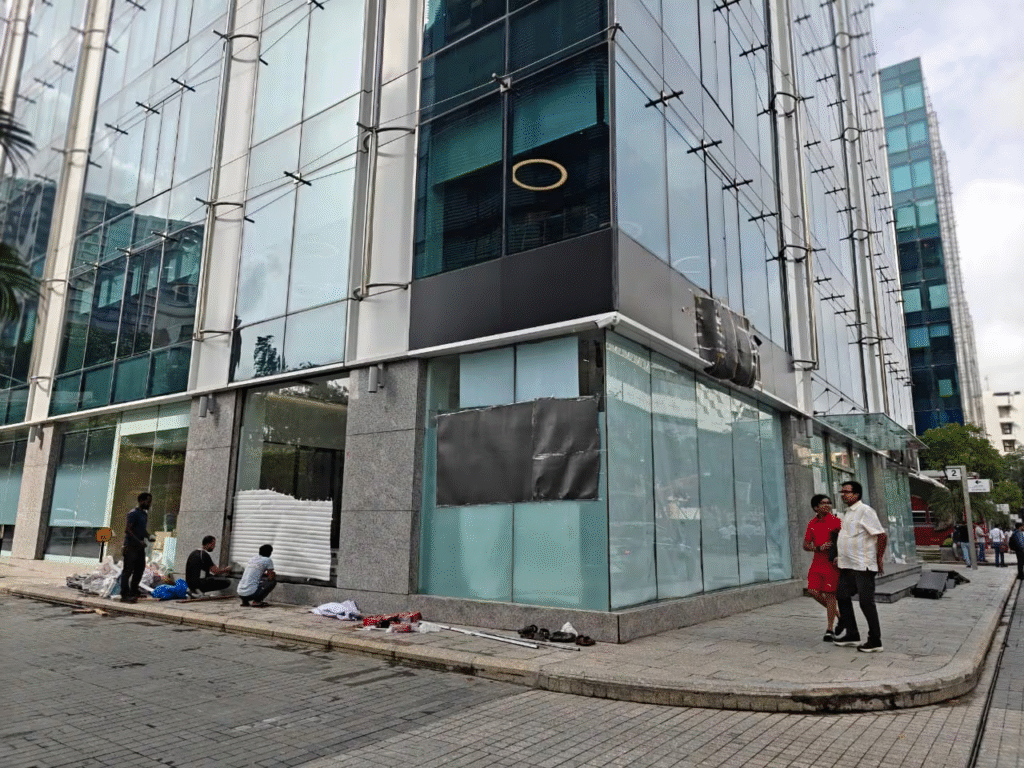

Tesla officially enters India on July 15, 2025, unveiling its inaugural experience centre in Mumbai’s prestigious Bandra Kurla Complex (BKC). This marks a historic milestone as the U.S. EV giant taps into the world’s third-largest automotive market

Venue: A 4,003 sq ft showroom at Maker Maxity, BKC – leased for 5 years at ~₹35 lakh/month with a 5% annual rent hike.

Launch Date: July 15, 2025 – dubbed an “experience centre,” initially offering vehicle displays and brand immersion but no test drives or deliveries at first .

Models Displayed: Six Tesla Model Y SUVs importe

- Base unit cost reported at ₹27.7 lakh (~$31,988).

- After/import duties (~₹21 lakh based on 70%), ex-showroom price exceeds ₹48 lakh ($56,000) before local taxes & insurance.

Global Price Contrast: In the U.S., the Model Y starts at $44,990 (or $37,490 after credits), meaning the Indian variant is nearly 25% pricier pre-taxes

Entry Approach: Instead of setting up local manufacturing, Tesla is focusing initially on retail via imported CBUs—leveraging global supply amid slowing demand in developed markets.

Metro Focus: After Mumbai, a second showroom in Delhi is expected to follow within July 2025.

Hiring Initiatives: Tesla has advertised 30+ roles across sales, service, supply chain, and autopilot, filling roles in Mumbai, Delhi, Pune, and Bengaluru

SPMEPCI Scheme: India’s EV incentive plan slashed import duties from 100% to 70% for vehicles priced over $35K—allowing Tesla to benefit even without local production.

Local Manufacturing Pressure: The government continues to urge Tesla to establish domestic production to access duty incentives and further reduce tariffs .

Investment Talks Stalled: Elon Musk postponed a planned India visit (2024), and Tesla remains non-committal on local factories despite earlier discussions of a $2–3 billion investment

Market Readiness: India’s EV penetration is ~5% of new vehicle sales; premium segments (<2%).

Volume Limitations: The high price tag could restrict Tesla to niche early adopters and affluent buyers.

Public SentimentCharging Ecosystem: India has limited fast-charging infrastructure—Tesla’s global Supercharger network is unmatched in other countries but must be built locally .

Service Hubs: A service centre in Kurla West and an engineering hub in Pune have been set up to support future operations.

Component Sourcing: Tesla may source parts from India valued at over $1 billion in 2025, offering future synergy if production scales

🇨🇳 Local Competition: Tesla’s move intensifies competition for Tata, Mahindra, and BYD in the premium EV space .

Global Strategy: With slowing demand in Europe and the U.S., India offers a growth frontier despite higher tariffs .

Financial Signals: Tesla’s global downturn in share price (~23 % drop over six months) adds urgency to crack new markets

July 15, 2025 – Mumbai showroom launch

4,003 sq ft – Experience centre size

50–70 units – Vehicles and accessories imported (~$1 million)

70% duty – Base import tariff

₹27.7 lakh – CBU declared price

₹48 lakh+ – Final ex-showroom price (US$56,000+)

5% – EV share in India’s new vehicle market

< 2% – Premium segment share

Tesla’s July 15 entry is historic—shifting India’s EV narrative into premium territory. But under the hood lie major challenges: steep import duties, nascent charging networks, and cautious consumer uptake. Success will depend on Tesla’s agility—its ability to tweak pricing, expand infrastructure, and commit to local ties. If it can navigate these, India may soon shift from being a luxury showcase market to a strategic growth engine.

Tesla’s entry into India via a July 15 experience centre in Mumbai is a landmark moment—but not without caveats. It represents the company’s first local retail footprint in India, relying on high tariffs and imported inventory, yet it also flags a deeper test of market readiness and policy alignment.

For now, Tesla is playing a niche role—luxury, aspirational, and small volume. The true test will be whether Tesla adapts its strategy by scaling infrastructure, offering competitive pricing, and aligning with India’s local production mandates. Only then can it transcend being a showcase brand and become a serious player in India’s evolving EV ecosystem.