Gold Hits 26 Record Highs in H1 2025 — Top 7 Smartest Ways to Buy the Precious Metal Now

Gold hits 26 record highs in H1 2025 amid global uncertainty. Discover the 7 smartest ways to invest in gold now — from SGBs and ETFs to digital gold and mining stocks

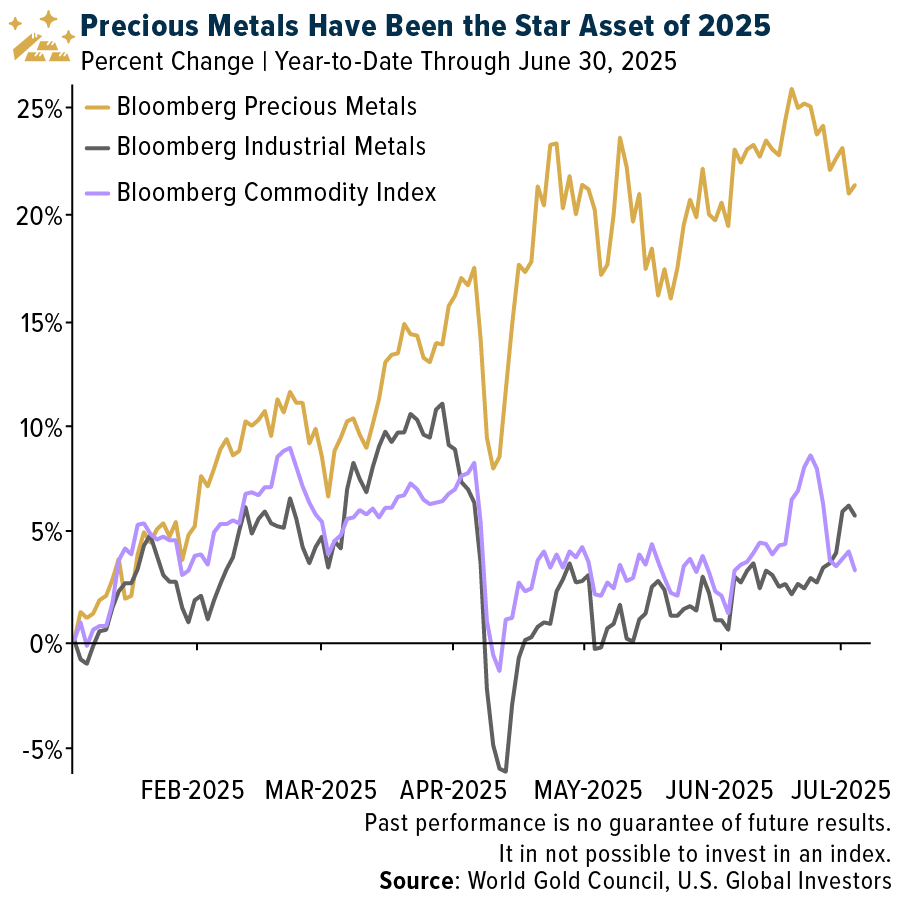

Gold closed the first half of the year as one of the top-performing major asset classes, rising 26 percent during the period. Globally, the precious metal recorded 26 new all-time highs in the first six months after breaking through 40 new records in the previous year.

According to the World Gold Council (WGC), a combination of a weaker US dollar, rangebound rates and a highly uncertain geo-economic environment has resulted in strong investment demand.

“If economists and market participants are correct in their macro predictions, our analysis suggests that gold may move sideways with some possible upside — increasing an additional 0-5 percent in the second half,” WGC said in a report.

However, the economy rarely performs according to consensus.

“Should economic and financial conditions deteriorate, exacerbating stagflationary pressures and geoeconomic tensions, safe-haven demand could significantly increase, pushing gold 10-15 percent higher from here. On the flipside, widespread and sustained conflict resolution – something that appears unlikely in the current environment – would see gold give back 12-17 percent of this year’s gains,” it said.

Experts recommend allocating only a small portion (5–10 percent) of the portfolio to precious metals, including silver.

Starting 2015, the Reserve Bank of India has launched 67 sovereign gold bonds (SGB) tranches, issuing 14.7 crore units. They are listed and traded in the cash segment of the BSE and the National Stock Exchange. Retail investors can buy and sell them through demat accounts.

Sovereign gold bonds are ideal but no new bond issuances are coming up.

SGBs are eight-year instruments with a five-year lock-in. Though they are listed on the stock exchanges, most are thinly traded. However, the RBI provides a buyback facility at the end of the fifth, sixth and seventh years.

Unitholders can submit their redemption requests during the designated windows through receiving offices, NSDL, CDSL, or RBI Retail Direct.

The goal of a gold ETF is to track the domestic physical prices of the metal. They are based on gold prices and invest in physical bullion.

Gold ETFs are units representing physical gold. One gold ETF unit equals 1 gram of gold, backed by high-purity physical metal.

Since gold ETFs are listed, they are safe and have higher liquidity. However, there are brokerage charges but way less than making charges for physical gold or jewellery. The expense ratio in gold ETFs is also lower than that of gold MFs.

As ETFs track the price of gold, they are subject to volatility. To invest in an ETF, one needs to have a demat account. There are entry and exit loads and the investor has to pay brokerage every time.

Gold MFs are open-ended funds that invest in units of Gold ETF. The ultimate goal of the mutual fund is to create wealth using the potential of gold as a commodity. Each gold MF has a fund manager who makes investment decisions according to the fund objective.

The gold MF units are priced differently as compared to ETFs. It is in the form of net asset value (NAV) disclosed at the end of the trading session.

Gold MFs are actively managed, so have the potential to outperform the metal price over time. They also offer the convenience of investing through a mutual fund house. However, these MFs have a higher expense ratio than ETFs, typically around 1-2 percent.

They come with the risk of underperformance — the returns could be lower than the gold price over time.

Gold MFs have low minimum investment requirements compared to gold ETFs, making them more economically accessible for retail investors. One does not need a demat account to invest in a gold MF.

A favourite with Indians, physical gold remains an attractive avenue but comes with its own limitations. Physical gold poses challenges from storage to purity perspectives. When you are looking at investing, you need well-regulated instruments and convenience, which if offered by gold ETFs and mutual funds.

Top commodity analysts from JPMorgan, Kotak Securities, and HSBC have issued bullish forecasts:

- JPMorgan: Gold could hit $2,900/oz by year-end if central bank buying continues.

- Kotak Securities: Indian gold prices may test ₹80,000 per 10 grams in festive season.

- HSBC: Gold will remain volatile but upward-trending due to macroeconomic stress.

Set your objective: Wealth preservation, trading, gifting, or passive income?

Choose your format: Physical vs Digital vs Financial Instruments

Watch for scams: Always buy from reputable dealers or regulated platforms.

Avoid overexposure: Gold should typically be 5–15% of your total portfolio.

Consider tax treatment: SGBs and ETFs offer better tax efficiency than physical gold.