India’s Informal Manufacturing Sector Faces Collapse as Tariffs Choke Growth

As argued in a recent column, against the backdrop of India’s projected robustness in economic performance, the first quarter of the fiscal year 2026 was anticipated to be a period of continued strength. The preceding quarter saw the economy demonstrate nominal momentum, clocking a brisk 7.4% GDP growth and prompting credit rating agencies like Fitch to upgrade their full-year forecasts on India, citing “sustained domestic resilience.”

Yet, India’s performance in the manufacturing space and workforce participation across informal manufacturing and MSMEs signal trouble. The first-ever release of quarterly data for the unorganised sector exposed a starkly different reality, revealing a tale of two Indias, one soaring, the other sinking.

The informal manufacturing sector, the bedrock of a labour-intensive economy that employs over 400 million workers, is collapsing. This abrupt contraction is the canary in the coal mine, signalling a structural malaise that questions the very sustainability of India’s growth story.

The data for April-June 2025 reads less like an economic update and more like a forensic report of a silent crisis.

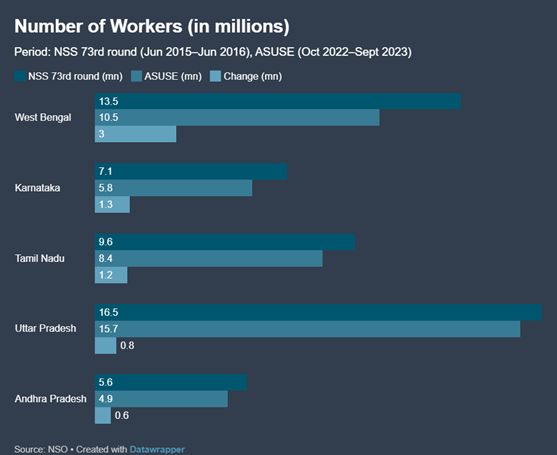

Employment in the informal manufacturing sector fell by 9.3% in April-June compared to January-March, dragging down informal sector employment by 2.1% to 12.86 crore. The number of enterprises shrank by -4.7%.

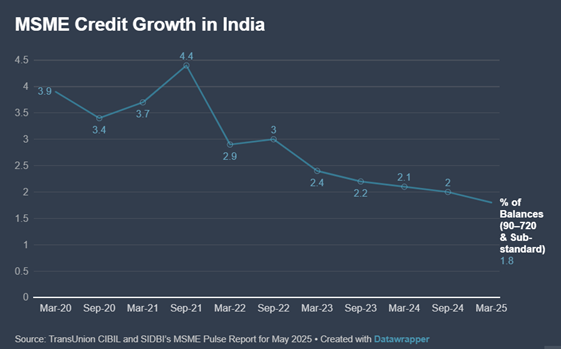

An investigation into the cause further lead to a frustrating dead end, as the usual suspects for such a downturn, runaway inflation, weak demand, or a credit crunch are unsubstantiated by the evidence. MSME sector’s own performance also needs a closer look which gets little attention in mainstream news cycles.

Despite a certain degree of macroeconomic stability, the hypothesis of a systemic credit crunch across MSMEs seemed untenable. According to RBI data, overall credit to the MSME sector was recently seen expanding at a robust 13% year-on-year. The core of the paradox still lies here though: if all the key economic signals were green, why has this critical sector been bleeding?

The anatomy of a collapse (since demonetisation)

The answer lies not in cyclical trends but in deep, structural pathologies and a dangerous misreading of the data. The “healthy” 6% growth in consumer spending likely masks a K-shaped recovery, where the affluent drive consumption of formal-sector goods and services while the mass market, which the informal economy serves, languishes. This divergence explains how demand can appear strong in aggregate while the order books of micro-entrepreneurs run dry.

This demand-side weakness exacerbates two long-standing structural flaws: the “capital chasm” and the “productivity trap.”

Despite headline credit growth, a colossal credit gap, estimated by the IFC at an estimated Rs.20–25 trillion persists. This is a market failure rooted in information asymmetry, leaving an estimated 86% of India’s over 63 million MSMEs unserved by the formal banking system. This financial starvation fuels a crippling productivity deficit.

A McKinsey report highlighted this chasm, noting that while MSMEs account for 62% of employment, they generate only 26% of manufacturing output.

This phenomenon of “dwarfism”, where firms fail to grow, scale, and innovate, is a direct consequence of this vicious cycle. Without capital, they cannot invest in technology or skills; without productivity gains, they cannot generate the profits needed to attract capital. This leaves them dangerously exposed to any shock, be it a dip in local demand or a global trade dispute.

This profound disconnects, where the formal corporate world embarks on a private capex boom while the informal sector spectates, raises a critical question: was the government’s policy framework equipped to even see this crisis, let alone solve it? The evidence points to an alarming mismatch.

The state wielded solutions for a reality that did not exist at the grassroots, offering financial lifelines to a segment of the economy that was already served, while the true crisis festered, unseen and untouched, at the economy’s base.

Allusion of a correct intervening industrial policy

The health of the informal sector and MSMEs is a matter of national economic security.

The Periodic Labour Force Survey (PLFS) consistently shows that over 90% of India’s workforce is engaged in informal employment, contributing an estimated 50% to the nation’s GDP. Its crisis is a national crisis.

Yet, the government’s policy response appears to be operating in a parallel universe, fundamentally misdiagnosing the illness. The Union Budget for 2025-26 doubled down on a strategy centred on enhancing formal credit supply, doubling the credit guarantee cover for micro-enterprises.

This approach is flawed on two levels. First, it addresses the wrong problem. A business whose output has collapsed because of a lack of customers does not primarily need a new loan; it needs orders.

For a distressed enterprise, taking on more debt is not a lifeline but a millstone, deepening its financial precarity. Second, it targets the wrong audience. These interventions are, by design, accessible only to those within the formal ecosystem.

The crisis was almost certainly most acute among the vast ocean of 86% of enterprises classified as “Own Account Enterprises” (OAEs), typically one-person operations without hired labour. These are the very entities that the government’s Udyam portal and credit schemes cannot reach.

This highlights a central tension in India’s economic strategy: the aggressive push for formalization.

While laudable as a long-term goal, policies like GST implementation and digital payment mandates place immense compliance burdens on the smallest players.

This can have the perverse effect of destroying informal livelihoods faster than the formal sector can create new ones. In this context, the government’s primary policy response, offering formal credit to solve a non-credit problem for a segment of the economy it couldn’t reach anyway, was not just ineffective; it was tragically irrelevant.

Geoeconomic coercion meets ground-level despair

Into this environment of pre-existing fragility, a powerful external shockwave is set to hit. In late August 2025, the United States imposed a staggering 50% tariff on a wide range of Indian exports.

This act of geoeconomic coercion targets India’s single largest market, valued at over $86 billion annually, and will strike the informal sector at its moment of maximum weakness. It threatens to convert the domestic slowdown into a deep and prolonged recession for key export clusters, with an immediate and devastating human cost.

Consider Tiruppur, which accounts for over 60% of India’s knitwear exports and serves as a primary supplier to the U.S. market.

A combined tariff of nearly 64% will render its products prohibitively expensive compared to those from Bangladesh, who face duties roughly of about 35-36.5%. For the estimated informal workers in the city, many paid a piece-rate, this means an instantaneous loss of income.

Or take Surat, which processes nine out of every ten diamonds sold globally and that made India’s exports to the US stand at over $7 billion. The industry, employing nearly a million artisans, was already in a protracted recession that had seen over 100,000 job losses. The new tariffs will be a crippling, perhaps final, blow.

The structural “dwarfism” of these enterprises means they have no financial cushion or pricing power to absorb this shock. This external blow risks a permanent reconfiguration of global supply chains as US buyers are forced to find more reliable suppliers. The confluence of an unexplained domestic collapse and a punitive external shock creates a perfect storm.

The critical data from Q1FY26 has been a distress signal gone unheeded. Now, as a tariff storm makes landfall on the labour-intensive sectors with exposure to an export-linked supply chain (connected to US or otherwise), India’s industrial ecosystem may find that its economic engine room, neglected, misunderstood, and starved of oxygen (via adequate demand and credit access).

An urgent and radical policy industrial policy pivot is needed with a reimagination of India’s linked comparative advantage, especially for MSMEs, informal manufacturing workforce, while moving away from misaligned credit-based palliatives and toward foundational factor-market reforms that address the structural disconnect that has brought a vital sector of the Indian economy to its knees.

Also Read: Gen Z Leader Sudan Gurung 2025: Breaks Down in Tears During Emotional Media Address in Kathmandu