Pakistan and Russia’s Strategic Steel Pact: Rebuilding Industrial Ties

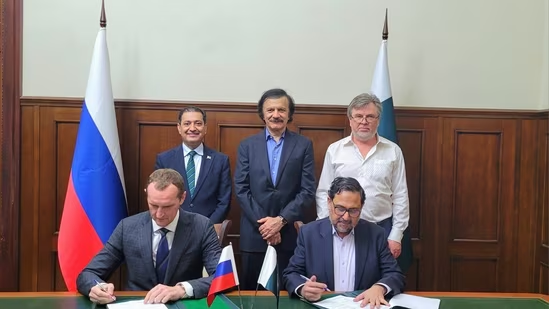

In a significant development that revives a historic alliance and charts a new economic path, Pakistan and Russia have signed a formal agreement focused on revitalizing the Pakistan Steel Mills (PSM) in Karachi, reaffirming their long-standing industrial partnership. This bilateral step not only marks a revival of collaboration between Islamabad and Moscow but also underlines a broader geopolitical recalibration amidst changing global power dynamics.

The agreement, which centers on technical assistance, operational revamp, and potential future investments in the long-dormant steel giant, reflects a pragmatic shift in both nations’ foreign and economic policy. For Pakistan, struggling with economic headwinds, a dilapidated manufacturing base, and record inflation, this engagement with Russia offers a rare opportunity to breathe new life into its industrial core. For Russia, the pact reflects an assertive step into South Asia at a time when Moscow is diversifying its economic partnerships beyond the West in the wake of prolonged geopolitical isolation post-Ukraine war.

A Historical Rewind: When Moscow Built Karachi’s Steel Dreams

The Pakistan Steel Mills, sprawling over 18,000 acres near Karachi’s coast, was conceived and constructed during the Cold War era—with crucial technical, financial, and material support from the former Soviet Union. The project symbolized not just Soviet industrial might, but also its soft power in cultivating strategic allies beyond its immediate borders. By the early 1980s, PSM had become one of the largest industrial enterprises in Pakistan, producing over 1.1 million tonnes of steel per year and offering direct and indirect employment to tens of thousands.

However, decades of political instability, corruption, and mismanagement led to PSM’s eventual collapse. Since 2015, operations at the mill have ceased entirely, transforming what was once a symbol of industrial promise into a rusting relic of Pakistan’s economic decline. Against this backdrop, Russia’s return to Karachi’s steel sector is both symbolic and strategic.

Why Now? Timing the Deal in a Multipolar World

The timing of the renewed agreement is far from accidental. With Russia seeking new trade corridors and investment opportunities in Asia, and Pakistan diversifying its foreign policy beyond traditional allies like the United States, China, and the Gulf, this deal is a confluence of converging needs. The shift is also driven by hard realities. Pakistan’s economic crisis has created a pressing need for foreign partnerships that can unlock infrastructure revival and reduce import dependence—particularly for critical materials like steel.

Moreover, Russia is actively pushing its economic diplomacy in the Global South. This includes renewed arms deals with India, energy cooperation with China, and increasingly, infrastructure investment in countries like Iran, Bangladesh, and now Pakistan. By investing in an iconic but defunct Pakistani asset like PSM, Moscow is sending a message: Russia intends to be a relevant economic force in Asia, even as it faces sanctions and exclusion from much of the Western-led global system.

Strategic Depth: What the Agreement Entails

Though the full text of the agreement has not been made public, government sources and reports from both sides confirm that Russia will initially provide technical expertise and industrial assessments of the Pakistan Steel Mills infrastructure, with a view to rehabilitating core production lines and modernizing outdated machinery. The second phase may include investment in renewable power supply for the plant, logistical support for raw material imports, and joint venture frameworks under a public-private partnership (PPP) model.

A task force comprising Russian metallurgical experts and Pakistani industrial engineers is being assembled to evaluate on-ground realities. Given the mill’s long dormancy, the assessment will not be limited to machinery but will also include site security, land zoning issues, utility connectivity, and potential environmental clearances for restarting operations.

This move also opens doors for discussions around local production of strategic-grade steel, something that Pakistan currently imports. In the long run, this could benefit the country’s defense manufacturing sector, infrastructure development programs, and railway and transport projects, particularly under CPEC (China–Pakistan Economic Corridor).

Diplomatic Layers: More Than Just Steel

On the surface, the agreement is an industrial venture. Beneath that surface, however, lies a web of geopolitical signals. By renewing its industrial ties with Pakistan, Russia is signaling its willingness to expand its strategic outreach in South Asia—traditionally a tightly contested geopolitical theatre.

Moscow’s overtures toward Islamabad come at a time when U.S.-Pakistan relations remain tepid and China dominates large-scale infrastructure investment in the country. Russia, however, brings a different flavor to the table—technical expertise without overt political strings, industrial partnerships over debt-driven mega-projects, and legacy credibility rooted in past cooperation.

In recent years, Pakistan has also sought to deepen ties with Russia in sectors like energy. Discussions around the Pakistan Stream Gas Pipeline—a major Russian-backed energy infrastructure initiative—are ongoing. Now, with the PSM deal, industrial cooperation is being added to that growing bilateral portfolio.

Domestic Implications: PSM as a Test Case for Economic Revitalization

For Pakistan, the rehabilitation of PSM is about more than nostalgia. It’s a potential test case for the revival of state-run enterprises, many of which are struggling under unsustainable losses. The government has repeatedly failed to privatize or reform these institutions due to political pushback and bureaucratic inertia. But if the Russia-backed revival of PSM succeeds, it could provide a model for public-private international partnerships to rebuild national industry.

Moreover, reactivating PSM could generate much-needed employment, bolster domestic steel supply, reduce import dependency, and feed major government infrastructure plans. If successfully modernized, the plant could supply steel to the housing sector, energy grid development, road and bridge construction, and even shipbuilding.

That said, challenges remain steep. PSM’s existing debt burden, legal entanglements, employee unions, and outdated infrastructure all pose serious hurdles. But for now, optimism has returned to a landscape long defined by decay.

As the dust settles on the signing ceremony of the Pakistan-Russia agreement to revive the Pakistan Steel Mills (PSM), the focus has now decisively shifted from diplomacy to deliverables. Behind closed doors, task forces on both sides are finalizing the timelines, work breakdown structures, and phased implementation plans necessary to breathe life back into the once-mighty steel giant. Officials have termed the deal as both “symbolic” and “substantive,” but for industry insiders, symbolism alone won’t reignite furnaces that have been cold for over a decade. Technical execution will be the true test.

A Step-by-Step Industrial Recovery Plan

According to early outlines of the agreement obtained from industry sources familiar with the matter, the revival of PSM will proceed in three distinct phases over a projected span of five years. The first phase, which is expected to last 12 to 18 months, will primarily involve a comprehensive technical audit of the entire facility. This includes assessment of the blast furnaces, rolling mills, coke oven batteries, power generation units, control systems, and logistical infrastructure such as conveyors, rail links, and water pipelines.

A joint technical team comprising engineers from Russia’s Metalloinvest Group and experts from Pakistan’s Ministry of Industries and Production will undertake a forensic-level inspection. Using drone scans, industrial AI modeling, and metallurgical diagnostics, the team will determine which parts of the plant are salvageable and which require total replacement.

The second phase—the restoration and modernization stage—will span approximately two years. This is where Russian investment, technology, and machinery imports will play a pivotal role. The goal is to bring back the plant’s production capacity to at least 1.1 million tonnes per annum, with modular scalability to double that figure in the future. Reports indicate that hybrid power solutions, including solar integration and LNG-based turbines, are being considered to address Karachi’s power instability.

The third phase will focus on workforce training, supply chain integration, and export alignment. Russian specialists will train local engineers on the new systems, while a joint board will negotiate logistics deals for the steady import of iron ore and coking coal—possibly from Russia or Central Asia via overland routes. Export avenues for value-added steel products to the Middle East, East Africa, and Central Asia will also be explored.

Former Employees Cautiously Optimistic

News of PSM’s revival has sparked a mix of cautious hope and deep skepticism among former employees and their families. Mohammad Qamar, a mechanical engineer who worked at the mills for over 30 years, describes the development as “a second chance, but only if lessons from the past are learned.”

He recalls the early years of the mill when Soviet engineers walked the halls and Pakistan’s industrial ambitions soared. “There was pride in wearing the PSM badge. The collapse wasn’t just a financial loss, it was emotional,” Qamar says. “But bringing in the Russians again? That’s smart. They know this place—they built it.”

At its peak, PSM employed over 17,000 direct workers and supported an estimated 50,000 families indirectly. Its shutdown not only devastated livelihoods but also created a vacuum in the country’s steel market, now largely dependent on expensive imports. Gulnaz Rafiq, whose father was a technician at PSM, hopes the new deal will come with social security reforms and fair recruitment. “Revival shouldn’t just be numbers on paper. The people who gave their lives to this mill should be the first to benefit.”

Technical Challenges and Infrastructure Realities

Despite the enthusiasm, engineers and economists alike are warning that the scale of the technical challenge is enormous. Much of PSM’s machinery is obsolete, dating back to the 1970s Soviet standard. Metal fatigue, corroded pipelines, broken furnaces, and a near-complete absence of digital systems make this a high-risk revival project.

A detailed environmental impact assessment is also pending. Since the shutdown in 2015, parts of the mill site have been encroached upon, and unchecked rust and chemical leaks have likely contaminated nearby water sources. Clearing these hazards without triggering labor unrest or political backlash will require precision and transparency.

Power is another major bottleneck. PSM has its own dedicated 110 MW power plant, but it is inoperative. Karachi’s broader grid, already under strain, cannot support heavy industrial loads without blackouts. Thus, one of the Russian proposals reportedly involves dual-fuel generators with LNG import integration, possibly through Karachi Port or Gwadar. If executed, this would be the first such industrial deployment of hybrid energy tech in Pakistan.

Political Spin and Media Narratives

The revival of PSM has quickly become a political talking point. Government ministers are hailing it as a landmark of economic diplomacy, while opposition figures are skeptical of Russia’s intentions and the deal’s long-term sustainability. In a recent press conference, Pakistan’s Minister for Industries, Dr. Gohar Iqbal, emphasized, “This is not a bailout—it is a resurrection. We’re not selling national assets; we are reviving them through strategic cooperation.”

In Russia, state-run media has framed the deal as proof of Russia’s global relevance, despite sanctions and the Ukraine war. RT and TASS carried favorable headlines like “Russia Rebuilds Steel Ties in Asia” and “Karachi Mill to Rise Again with Moscow’s Help.” While such coverage reflects Kremlin-aligned messaging, it also underscores how the pact fits into Russia’s broader goal of increasing economic influence in the Global South.

Independent analysts, however, are more circumspect. Dr. Maria Khokhlova, an expert on Eurasian trade at the Moscow State Institute of International Relations, believes the deal “aligns more with regional influence building than purely economic rationale.” She points out that many Russian industries are currently under strain, and significant capital allocation to foreign infrastructure projects may invite scrutiny at home.

Regional Implications and Strategic Concerns

Beyond bilateral optics, the PSM agreement also carries implications for regional geopolitics. With India and Russia maintaining strong defense ties, and China holding economic dominance in Pakistan, Moscow’s growing involvement introduces a new variable in South Asia’s balance of power. Though not directly threatening to either Delhi or Beijing, it adds a layer of complexity to existing alignments.

For China, which has heavily invested in Pakistan’s infrastructure under the CPEC umbrella, Russia’s re-entry may be seen as either complementary or competitive. Some analysts argue that Russia’s presence could stabilize Pakistan’s industrial sector, creating better downstream opportunities for Chinese-funded infrastructure. Others believe it may dilute Beijing’s leverage.

India, on the other hand, will be watching the deal with strategic interest. While Delhi maintains strong ties with Moscow, a deeper Russia-Pakistan relationship—especially one that includes future defense technology transfers or energy security cooperation—could trigger diplomatic recalibrations.

As Pakistan and Russia proceed with the multi-year revival plan of Pakistan Steel Mills (PSM), one of the most immediate challenges facing the project is energy. For a steel plant of PSM’s scale—designed for heavy industrial processes such as smelting, rolling, forging, and coke processing—power is not just an input, it is the lifeblood of the entire operation. Without a reliable, affordable, and scalable energy solution, even the most technically sound revival blueprint could collapse under the weight of logistical reality.

The Energy Equation: More Than Just Electricity

Pakistan’s power grid has long been under stress. With a generation capacity that oscillates between surplus and shortfall—depending on seasonal demand, circular debt crises, and transmission inefficiencies—the country’s energy ecosystem is not equipped to independently sustain large-scale industrial undertakings. When PSM was operational in its prime, it relied heavily on its own captive power generation: a dedicated 110 MW plant, supported by gas pipelines, coal storage, and water reservoirs. That system has since been rendered obsolete.

To address this, Russian negotiators have proposed an integrated energy solution that includes dual-fuel generation units, leveraging both natural gas (LNG) and solar microgrids to support stable operations. The hybrid model, while ambitious, is rooted in technical precedent—Russia has deployed similar setups in parts of Central Asia and Siberia for mining and steel refining clusters.

According to sources within the Ministry of Energy, Pakistan is exploring a plan to connect the revived PSM to Karachi’s LNG supply hub with a dedicated sub-terminal for industrial consumption. Talks are also underway with private-sector LNG importers to structure a special tariff for PSM, insulating it from volatile spot market prices. If implemented, this would mark a significant structural shift in how industrial projects are powered in Pakistan.

Solar, meanwhile, will serve a complementary role. Russian firms have suggested deploying photovoltaic panels across portions of the vast 18,000-acre PSM land—particularly in non-operational and unused segments. This energy will support low-load operations, lighting, security systems, and water treatment units. While not capable of driving furnaces, solar energy will reduce auxiliary power costs and environmental pressure.

Legal Framework and Financial Model: Who Owns What?

Beyond engineering and infrastructure, one of the more complex layers of the revival project is the legal and financial structure of the joint venture. Contrary to some political claims that Russia is “buying” PSM, insiders have confirmed that no equity sale has taken place. The agreement, as of now, is built around a rehabilitation-based Build-Operate-Transfer (BOT) model, wherein Russian industrial entities will help refurbish, modernize, and operate the facility for a fixed term—estimated between 15 and 20 years—after which operational control reverts to the Pakistan government.

This model is not new, but its implementation will be closely scrutinized. In past infrastructure projects, including those under CPEC and previous IMF-backed privatizations, governance lapses and misaligned expectations have derailed execution. To mitigate such risks, Pakistan is setting up a Special Purpose Vehicle (SPV) for the PSM revival. This legal entity will act as the operational custodian, insulating the mill’s commercial operations from bureaucratic interference, while still retaining state oversight.

The financial commitment on Russia’s end has not been disclosed publicly, but early estimates suggest an initial investment envelope of $350–$400 million, spread over five years. This includes machinery imports, technical consulting, energy integration, workforce training, and process digitization. Pakistan’s contribution will come in the form of land access, policy support, and utility infrastructure rehabilitation.

Crucially, both sides have agreed to joint profit-sharing based on an annual performance audit. This arrangement is designed to incentivize efficiency, reduce operational losses, and prevent the recurrence of past fiscal hemorrhages. Still, critics argue that without transparent auditing mechanisms, the model may be vulnerable to the same opacity that once plagued PSM’s financial records.

Environmental Clearance and Land Reform: Cleaning the Steel Graveyard

The Pakistan Steel Mills complex is not just an idle industrial facility—it is also an environmental and urban planning challenge. Years of disuse, neglect, and unmanaged decay have turned large parts of the facility into zones of chemical leakage, metal corrosion, and biohazard risk. Restarting such a facility without thorough environmental due diligence would be not only irresponsible but potentially catastrophic for Karachi’s coastal ecosystem.

To that end, the Sindh Environmental Protection Agency (SEPA), in coordination with Russian environmental engineers, is conducting a full Environmental Impact Assessment (EIA). The assessment focuses on four key zones: the blast furnace yard, coal and coke storage facilities, water discharge canals, and solid waste dumps. Early signs suggest high contamination levels in parts of the soil and groundwater near the east-side boundary, with possible leaching into surrounding communities during the monsoon season.

If the EIA flags serious health risks, remediation could delay operational restart by months, or even years. Russian firms are reportedly open to funding and executing cleanup operations, but only within the financial contours already agreed upon. Additional government support, including possible World Bank or Asian Development Bank (ADB) environmental grants, may be required.

The issue of encroachment and informal settlements on PSM land is also under legal review. Over the past decade, parts of the complex—especially on its western fringes—have been occupied by unauthorized residential settlements, industrial scrapyards, and local transport terminals. Their removal, while legally mandated, will trigger social tensions. The Sindh government has been asked to prepare a resettlement and compensation framework in anticipation of legal challenges and public protests.

The Cost of Doing Nothing: Lessons from Inertia

The decision to revive PSM is more than an economic move—it’s a political reckoning with the cost of inaction. Since the mill shut down in 2015, Pakistan has spent over $5.5 billion on steel imports, often at fluctuating prices that burden the national exchequer and worsen the trade deficit. Meanwhile, local infrastructure projects—from metro lines to housing schemes—have faced cost escalations due to steel procurement bottlenecks.

Moreover, the death of PSM symbolized a broader rot in public-sector enterprise management. Once regarded as a national pride project, its decay eroded public trust in state stewardship. Bureaucratic turf wars, political patronage, and years of underinvestment reduced it to a ghost facility. Reviving it now, with international cooperation, may offer a roadmap for salvaging other ailing institutions—such as Pakistan International Airlines (PIA), Pakistan Railways, and the Water and Power Development Authority (WAPDA).

The symbolic weight of the revival, therefore, is heavy. It’s not just about producing steel again. It’s about reclaiming industrial dignity, reasserting strategic autonomy, and rewriting the narrative of public-sector failure in a country where such stories are far too common.

Also Read : Car Stunt Ends in Disaster: SUV Plunges Into 300-Foot Ditch in Maharashtra, Driver Miraculously Survives