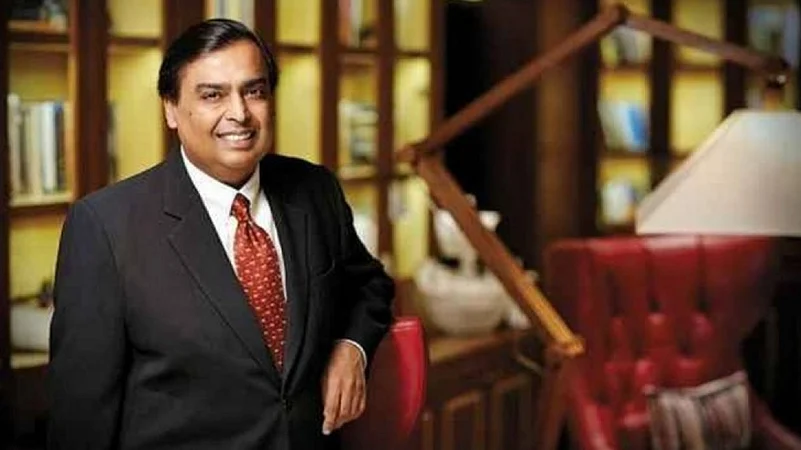

Reliance Communications Warns: SBI Set to Label Loan Account ‘Fraud’ – Anil Ambani Reported to RBI Amid ₹X,XXX Crore Crisis In 2025

Reliance Communications alerts SBI plans to declare its loan account as ‘fraud’; Anil Ambani reported to RBI amid a major financial scandal

State Bank of India has decided to mark Reliance Communications’ loan account as “fraud” in a case that stretches back to August 2016. India’s largest state-run lender made this clear in a letter dated 23 June 2025. The letter reached the company on 30 June.

Reliance Communications confirmed this move in an official filing under market rules. “This is to inform you that Company has received letter dated June 23, 2025 (received on June 30, 2025) from SBI (marked to the Company and its erstwhile director – Anil Dhirajlal Ambani), inter alia, stating that SBI has decided to report the loan account of the Company as ‘fraud’ and to report the name of Anil Dhirajlal Ambani (erstwhile director of the Company) to the RBI, as per the extant RBI guidelines,” ..

This did not happen overnight. SBI issued show cause notices in December 2023, March 2024 and again in September 2024. The bank says it looked at the replies. It found the company failed to explain why it broke the terms of the loan. The bank also says the company did not satisfy its questions about irregularities in how the account was run.

In a startling financial development shaking India’s corporate and banking sectors, Reliance Communications (RCom) has reportedly informed the State Bank of India (SBI) that its loan account is on the brink of being classified as ‘fraud’. This revelation has escalated tensions, prompting reports that Anil Ambani, chairman of Reliance Communications, is being reported to the Reserve Bank of India (RBI) for alleged financial irregularities and loan default linked to a staggering sum.

This article delves into the background of the loan dispute, the significance of SBI’s impending ‘fraud’ declaration, the implications for Anil Ambani and Reliance Communications, and the wider impact on India’s financial and corporate governance landscape.

Reliance Communications, once a telecom giant in India and part of the Ambani business empire, has faced a rapid decline over the last decade. Heavy competition, massive debt burdens, and failed merger attempts led to financial distress. By 2023, RCom was grappling with non-performing assets (NPAs) and huge unpaid loans across multiple banks, including the State Bank of India.

- Loan Exposure: SBI, India’s largest public sector bank, reportedly holds a significant portion of RCom’s debt portfolio, which runs into thousands of crores of rupees.

- Debt Restructuring Attempts: Over the years, RCom attempted debt restructuring, but continued losses and asset liquidation failures hampered recovery efforts.

The latest developments mark a critical juncture as the bank takes a hardline approach to recover dues and enforce accountability.

When a bank declares a loan account as ‘fraudulent,’ it signals a severe breakdown of trust and financial compliance between the borrower and lender. The Reserve Bank of India defines fraud in banking as any act by the borrower or its representatives which is intended to cause wrongful loss to the bank or wrongful gain to any person.

- Legal Actions: Banks can initiate criminal proceedings against the borrower, including investigations by the Central Bureau of Investigation (CBI) or Enforcement Directorate (ED).

- Asset Seizure and Recovery: The bank moves aggressively to seize assets and recover dues through legal channels.

- Blacklisting: The borrower is blacklisted, severely limiting future credit access.

- Reputational Damage: Being labeled a fraudster affects the individual and the company’s market credibility and investor confidence.

In the case of Reliance Communications, SBI’s move to classify the loan as fraud implies the bank suspects deliberate misappropriation or concealment of facts by RCom’s management.

Sources reveal that SBI has been in extended talks with RCom management but was dissatisfied with their responses and repayment proposals. The mounting dues and failure to provide clear explanations about fund usage raised red flags.

- Internal Audit Findings: SBI’s internal audit and risk teams flagged discrepancies in loan utilization and financial reporting.

- Board-Level Discussions: SBI’s board reportedly gave clearance to treat the loan account as fraud to protect the bank’s interests and recover dues faster.

- Reporting to RBI: Following protocol, SBI has reported the matter to the Reserve Bank of India, which oversees banking operations and ensures systemic stability.

This represents a significant escalation from mere loan default to potential financial fraud.

Anil Ambani, chairman of Reliance Communications, faces immense scrutiny amid these developments. Once a high-profile business magnate, Ambani’s fortunes have reversed dramatically due to mounting debt and failed ventures.

- Personal Liability: Although corporate laws protect individuals to some extent, in cases of proven fraud, directors and promoters like Ambani can be held personally liable.

- RBI’s Role: The RBI can impose penalties, restrict banking privileges, or recommend further investigations. Reporting a corporate promoter to the RBI is rare and indicates the severity of allegations.

- Public and Investor Reaction: This has spooked investors, creditors, and market analysts, raising doubts about governance standards at RCom.

The fraud declaration, if finalized, will have cascading effects on RCom’s business operations and restructuring efforts.

- Access to Credit: Banks will likely halt further lending, stalling business activities and debt refinancing.

- Asset Sales: Accelerated attempts to liquidate assets may follow, possibly at distressed prices.

- Legal Battles: RCom may face prolonged litigation with SBI and other creditors, draining resources further.

- Market Position: The company’s reputation will suffer, affecting relationships with partners and customers.

For a company already struggling, this could mark the beginning of the end.

The SBI-RCom episode highlights systemic risks in India’s banking ecosystem.

- NPA Crisis: Corporate loan defaults are a major contributor to India’s non-performing assets, impacting bank profitability and lending capacity.

- Governance and Oversight: The case raises questions on due diligence by banks and regulatory oversight to prevent loan misuse.

- RBI’s Regulatory Role: RBI’s involvement underscores its mandate to safeguard financial stability and enforce compliance.

Banks are under pressure to improve risk management and transparency to restore public confidence.

Several laws and regulations come into play:

- The Banking Regulation Act, 1949: Provides RBI powers to regulate banking operations and intervene in fraudulent cases.

- The Insolvency and Bankruptcy Code (IBC), 2016: Allows creditors to initiate insolvency proceedings against defaulters.

- Companies Act, 2013: Includes provisions to hold directors accountable for fraud and mismanagement.

- Prevention of Money Laundering Act (PMLA): Investigates if proceeds from fraud are laundered.

The coming months are critical. The process involves:

- Finalization of Fraud Status: SBI’s forensic audits and RBI’s review will determine the official status.

- Legal Proceedings: Possible CBI or ED investigations may begin.

- Debt Resolution: Insolvency proceedings could be initiated if restructuring fails.

- Corporate Governance Reforms: This case could trigger stricter norms and accountability demands.

The RCom saga serves as a stark reminder:

- Transparency is Non-Negotiable: Companies must maintain clear, honest financial reporting.

- Banking Vigilance: Banks need robust checks to detect early signs of financial stress or fraud.

- Regulatory Vigilance: Timely intervention by regulators is crucial to prevent escalation.

- Ethical Leadership: Corporate leaders must uphold fiduciary responsibilities with integrity.

Read Also : Dalai Lama’s 15th Rebirth to Happen Abroad – China Power Struggle Intensifies in 2025