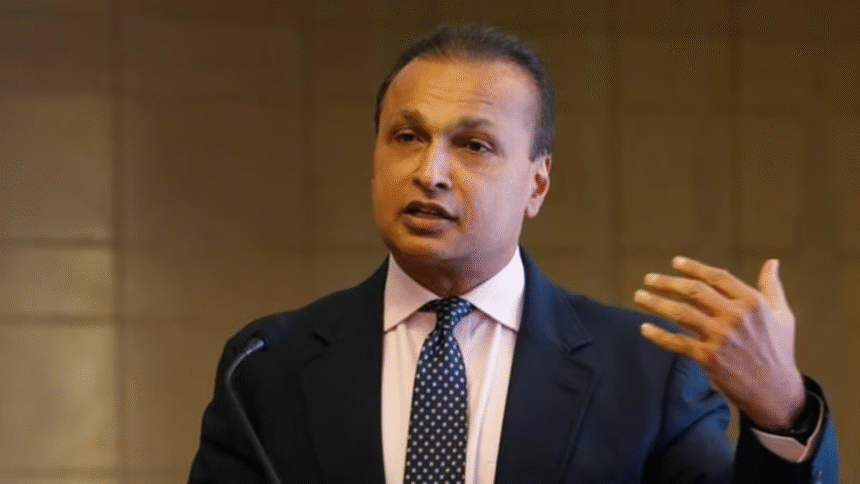

ED Raids 9 Anil Ambani Group Offices Across Mumbai & Delhi in ₹800 Crore Money Laundering Probe

ED raids 9 Anil Ambani Group offices in Mumbai and Delhi in connection with a ₹800 crore money laundering investigation

The Enforcement Directorate (ED) on Thursday conducted searches at multiple premises linked to industrialist Anil Ambani in Mumbai. The raids, carried out by teams from Delhi and Mumbai, are reportedly part of a larger money laundering investigation. Sources suggest the action is connected to financial irregularities and offshore transactions flagged in earlier probes

The ED has not issued an official statement yet, but officials confirmed the searches are ongoing. This development marks a significant escalation in the scrutiny of the businessman’s financial dealings and corporate entities under his control.

According to the sources, ED conducting searches around 40 locations. The Enforcement Directorate (ED) raided multiple premises associated with Anil Ambani’s group companies in Mumbai as part of a widening money laundering investigation. While Ambani’s personal residence was not searched, ED teams from Delhi and Mumbai targeted offices of Reliance Anil Dhirubhai Ambani Group (RAAGA) companies, based on inputs from several agencies including SEBI, NHB, NFRA, Bank of Baroda, and two CBI FIRs. The ED serch operation is in connection with the Yes Bank loan fraud case. ED searches underway on premises linked to Anil Ambani in connection with Yes Bank loan fraud and other cases against the companies linked to Ambani. Raids underway across India mainly Mumbai and Delhi.

ED teams from Delhi and Mumbai targeted offices of Reliance Anil Dhirubhai Ambani Group (RAAGA) companies, based on inputs from several agencies including SEBI, NHB, NFRA, Bank of Baroda, and two CBI FIRs.

The probe centers on the alleged illegal diversion of Rs 3,000 crore in loans from Yes Bank during 2017–2019. The ED claims that these funds were routed to entities linked with the bank’s promoters shortly before being disbursed to RAAGA firms. Notably, Reliance Home Finance Ltd (RHFL) is under the scanner after a sharp jump in loan disbursals from Rs 3,742.6 crore in FY18 to Rs 8,670.8 crore in FY19. A possible bribery link involving former Yes Bank executives is also being investigated.

ED officials believe the group engaged in a systematic plan to mislead investors, banks, and regulators, diverting public funds for unauthorized purposes. Several senior executives of the group are also being questioned.

This follows SBI’s move on June 13, 2025, to declare Anil Ambani and Reliance Communications (RCom) as ‘fraud’ under RBI guidelines. SBI reported the case to the RBI and is preparing to file a complaint with the CBI.

RCom, already under CIRP, owes SBI Rs 2,227.64 crore in principal and Rs 786.52 crore in guarantees. SBI has also initiated personal insolvency proceedings against Anil Ambani.

In a major development that sent shockwaves through India’s corporate and financial circles, the Enforcement Directorate (ED) on Wednesday launched coordinated raids at multiple premises linked to industrialist Anil Ambani’s Reliance Group. The raids, conducted across 9 locations in Mumbai and Delhi, are part of an ongoing investigation into alleged money laundering amounting to ₹800 crore.

Sources in the Enforcement Directorate revealed that the raids are connected to a broader investigation involving suspicious financial transactions and possible violations under the Prevention of Money Laundering Act (PMLA), 2002. The ED is probing the flow of funds linked to Anil Ambani’s group companies, including foreign investments, offshore entities, and alleged round-tripping of money through shell companies.

The crackdown was launched early in the morning, with ED officials entering multiple corporate offices and private residences associated with the Reliance ADA (Anil Dhirubhai Ambani) Group. Some of the key companies under the scanner include Reliance Infrastructure, Reliance Power, and Reliance Capital.

ED officers reportedly seized digital records, financial documents, internal emails, and transaction data during the raids. The seized evidence is now under forensic analysis to determine if any illicit transactions were disguised as legitimate business activities. Investigators are also looking into foreign bank accounts and investments made through tax havens.

According to officials, at least a dozen individuals, including financial advisors, chartered accountants, and senior executives from the Ambani-led conglomerate, are under the ED’s radar and may be summoned for questioning in the coming days.

This is not the first time Anil Ambani’s group has faced scrutiny. Over the past few years, several of his companies have been in the spotlight for mounting debts, defaulted loans, and failed infrastructure ventures. In 2020, Anil Ambani had claimed in a UK court that he was virtually bankrupt, stating that he had zero net worth and could not repay loans extended by Chinese banks—claims that were widely questioned in the business community.

ED officials believe that the latest probe may uncover how funds were diverted, layered, and laundered under the guise of corporate restructuring or overseas investment.

The ED’s action comes at a time when the Indian government is increasing pressure on large corporations and high-net-worth individuals involved in economic offences. The raid on such a high-profile business figure has once again ignited debates around corporate governance, regulatory loopholes, and the opacity of offshore financial structures used by Indian firms.

Although the Anil Ambani Group has not issued a formal response yet, sources close to the company have termed the raids as “routine compliance checks” and denied any wrongdoing. However, legal experts say that the ED’s involvement suggests far more serious allegations, which could result in criminal charges and asset seizures if proven.