Income Tax Slabs Budget 2026 LIVE: 7 Big Announcements on Tax Cuts — What Every Taxpayer Must Know

Income Tax Slabs Budget 2026 LIVE: Check latest income tax rates, slab changes, tax cuts, rebates, and what relief taxpayers received in Budget 2026

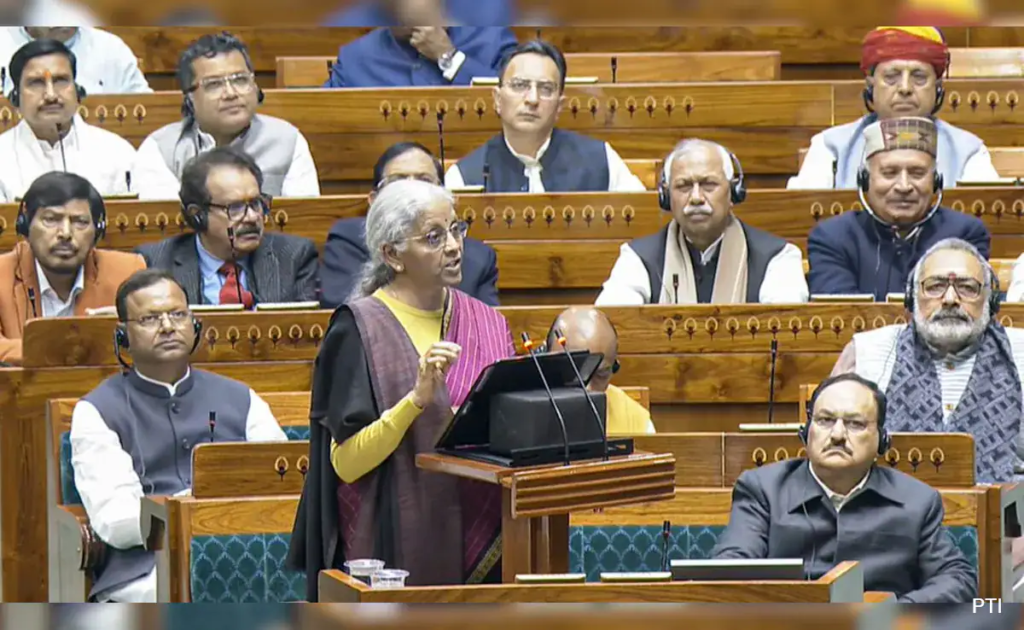

The Union Budget 2026, presented by Finance Minister Nirmala Sitharaman, was closely watched by millions of Indian taxpayers hoping for income tax relief, slab revisions, and higher exemptions. With rising inflation, cost of living pressures, and increasing household expenses, expectations were high for meaningful tax cuts in Budget 2026.

However, the biggest headline this year is clear: there are NO changes in income tax slabs. While taxpayers did not receive fresh slab cuts, the government introduced important compliance relaxations, rebates, deductions, and a brand-new Income Tax Act that aims to simplify India’s taxation framework.

This article breaks down everything taxpayers need to know about Income Tax Slabs in Budget 2026, including new regime slabs, old regime rules, rebates, standard deductions, and whether this budget truly benefits middle-class Indians.

In Budget 2026, the government retained the existing income tax slab structure under the new tax regime. This means there is no increase in the basic exemption limit and no direct reduction in tax rates for salaried individuals or professionals.

New Income Tax Slabs for FY 2026–27 (AY 2027–28)

| Income Range | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Although slab rates were not lowered, the Section 87A rebate continues, ensuring that individuals earning up to ₹12 lakh per year under the new tax regime pay zero income tax.

Key Relief Highlights

- Income up to ₹12 lakh = Zero tax liability

- Standard deduction of ₹75,000 retained

- Effective tax-free salary income up to ₹12.75 lakh for salaried individuals

- Continued marginal relief to avoid sudden tax spikes above ₹12 lakh

This means that middle-class salaried taxpayers still enjoy strong tax relief, even though no new cuts were introduced

Taxpayers can still choose between the old tax regime and the new default regime.

Old Regime Benefits Include

- Section 80C deductions (up to ₹1.5 lakh)

- HRA (House Rent Allowance)

- Home loan interest deduction

- Section 80D (medical insurance)

- Other exemptions and savings-linked benefits

The old tax slabs remain unchanged, giving taxpayers flexibility to choose the most beneficial option based on income structure

One of the key benefits for salaried employees is the retention of the ₹75,000 standard deduction under the new tax regime.

What This Means

- Reduces taxable income automatically

- Raises the effective zero-tax threshold

- Helps salaried taxpayers manage inflation pressure

- Supports middle-income earners without requiring investment-linked deductions

While there was no increase in the deduction amount, retaining it provides continued relief.

A major reform announced in Budget 2026 is the implementation of the new Income Tax Act, 2025, replacing the 1961 Income Tax Act.

Purpose of the New Law

- Simplify legal language

- Reduce litigation and disputes

- Improve tax compliance

- Make filing easier with simplified forms

- Digitally streamline processes

This is one of the most structural tax reforms in decades, even though slabs remain unchanged

To improve compliance flexibility, the government extended the deadline for revising Income Tax Returns (ITR).

New Rule

- Taxpayers can revise ITR until March 31

- Earlier deadline was December 31

- Nominal fee applies

This helps:

- Salaried individuals

- Freelancers

- Small business owners

- Taxpayers correcting reporting errors

Although income tax slabs were unchanged, TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) received meaningful adjustments.

Key Changes

- TCS on overseas tour packages reduced to 2% (from 5–20%)

- TCS on foreign education and medical expenses reduced to 2%

- PAN-based TDS for NRI property sales

- Simplified TDS for manpower services

These measures reduce cash-flow burden and simplify compliance, especially for students, NRIs, and international travelers

Budget 2026 introduced a 20-year tax holiday for foreign companies operating cloud and data center services in India.

Impact

- Boosts foreign investment

- Encourages global tech companies to use Indian data centers

- Strengthens India’s digital economy

- Improves long-term tax clarity

This reform aims to position India as a global cloud and digital hub

✅ MAT Rate Reduced

- Minimum Alternate Tax (MAT) reduced from 15% to 14%

- MAT credit phase-out plan announced

✅ Foreign Asset Disclosure Scheme

- One-time 6-month window to disclose small foreign assets

- Relief for NRIs, students, and professionals

✅ Buyback Tax Expanded

- Share buybacks taxed for all companies

✅ STT Increased

- Securities Transaction Tax raised on futures & options

✅ Tax Exemption on Motor Accident Compensation Interest

These changes impact corporates, investors, and global income earners

What Middle-Class Got

✔ Continued ₹12 lakh zero-tax benefit

✔ ₹75,000 standard deduction retained

✔ Simplified tax rules coming

✔ Lower TCS on education and travel

✔ Extended ITR revision deadline

What They Didn’t Get

❌ No slab reduction

❌ No increase in exemption limit

❌ No additional deduction benefits

❌ No inflation-indexed relief

While no new tax cuts were introduced, the government focused on stability, simplification, and compliance relief.

Experts say Budget 2026 did not deliver dramatic tax relief, but it:

- Maintains predictability

- Avoids fiscal strain

- Focuses on structural reforms

- Prepares India for a simplified long-term tax system

However, many taxpayers expected inflation-linked relief, which was not delivered