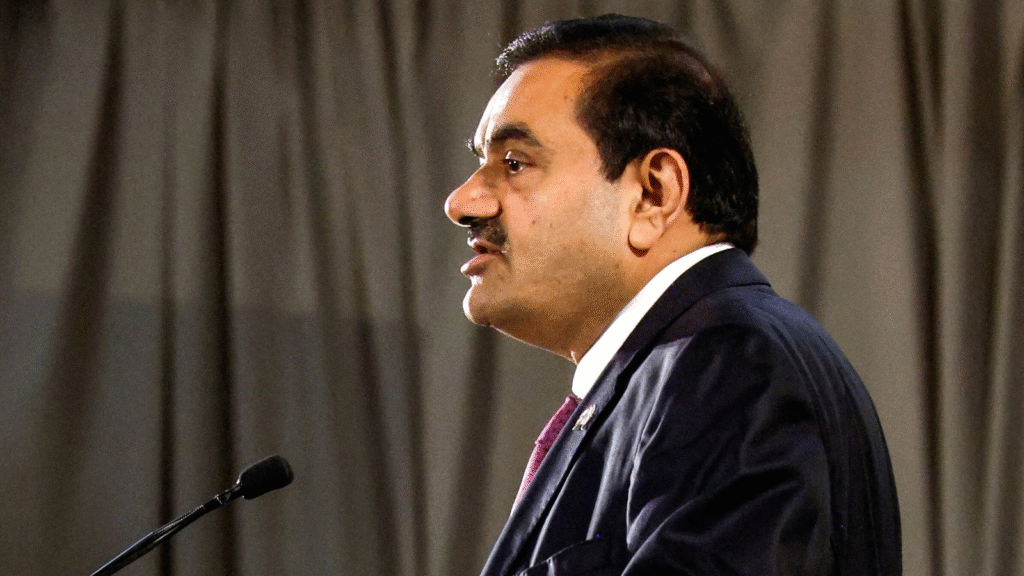

US Regulators Slam Indian Authorities Over Failure to Serve $4.3B Summons to Gautam Adani

US regulators accuse Indian authorities of failing to serve a $4.3 billion legal summons to billionaire Gautam Adani, intensifying global scrutiny over the Adani Group’s regulatory compliance

A legal battle in the Eastern District of New York involving Indian billionaire Gautam Adani is facing persistent delays, with the US Securities and Exchange Commission (SEC) telling a federal court that Indian authorities have yet to serve formal summons to the Adani Group chairman and his associates. The SEC’s latest status report, filed on August 11, claims there are procedural hurdles in serving the summons, which must be done in compliance with the Hague Service Convention.

The civil lawsuit, originally filed last year, accuses Gautam Adani, his nephew Sagar Adani, and other related individuals of securities law violations and misleading representations linked to Adani Group activities. The charges stem from an alleged scheme to pay roughly $265 million in bribes to Indian government officials to secure lucrative solar power contracts, a fact that prosecutors say was concealed from US investors. The Adani Group has consistently denied these allegations, dismissing them as “baseless.”

The status report, reviewed by India Today, shows that while the SEC has been actively attempting to advance the federal lawsuit — stemming from allegations of securities law violations and misleading representations tied to Adani Group activities — progress has stalled due to procedural bottlenecks involving cross-border legal cooperation.

According to a previous report from July, the SEC had informed the New York court that nearly four months after requesting assistance from India’s Ministry of Law and Justice in February, the summons remained unserved. The Law Ministry had reportedly forwarded the request to a court in Ahmedabad, Gujarat, but the SEC had received no confirmation of the summons being issued.

In its most recent filing, the SEC confirmed it has continued to communicate with the Indian Law Ministry and is pursuing service under the Hague Convention. However, it stated that as of August 11, Indian authorities “have not yet effected service” despite ongoing correspondence. The SEC also noted that it had issued “Notices of Lawsuit and Requests for Waiver of Service of Summons” directly to Adani’s legal counsel in India as an additional measure.

The legal process is a direct result of an indictment unsealed in a New York court on November 22, 2024, which charged Adani and others with bribery and fraud. The indictment detailed allegations of a bribery scheme spanning from 2020 to 2024 to secure solar power contracts from Indian state electricity distribution companies. The US has jurisdiction in the matter because it alleges the Adani Group misled American banks and investors while raising billions for the solar energy project.

The SEC’s civil action is separate from the criminal prosecution but stems from the same core allegations.

New Delhi/Washington — A fresh wave of controversy has engulfed the Adani Group after U.S. regulators accused Indian authorities of failing to deliver a crucial legal summons to billionaire industrialist Gautam Adani in connection with a $4.3 billion case. The development has added to the mounting global scrutiny over the conglomerate’s financial dealings and regulatory compliance.

According to official filings in a U.S. federal court, American regulators claim they have been attempting to serve legal summons to Adani in relation to an ongoing investigation, but the process has stalled due to what they allege is “non-cooperation” from certain Indian government agencies. The summons reportedly pertains to a high-profile financial dispute involving securities regulations and potential violations of U.S. investor protection laws.

The regulators assert that repeated requests for assistance under international judicial cooperation agreements have either gone unanswered or been delayed to the point of procedural failure.

“Despite clear obligations under bilateral treaties, the necessary service of process has not been completed,” a spokesperson for the U.S. regulatory body said. “This undermines the integrity of cross-border enforcement.”

Indian officials, however, have rejected accusations of deliberate non-cooperation. A senior government source told media outlets that the matter is “under active review” and that procedural complexities are behind the delay.

“These cases require strict adherence to both Indian and international legal frameworks,” the official said. “Any suggestion that India is deliberately obstructing legal processes is unfounded.”

The Ministry of External Affairs (MEA) is believed to be coordinating with the Ministry of Corporate Affairs and relevant judicial bodies to determine the next steps.

The allegations come at a sensitive time for the Adani Group, which has been under the global spotlight since the January 2023 report by U.S.-based short-seller Hindenburg Research accused the conglomerate of stock manipulation and accounting irregularities — claims the group has vehemently denied.

Since then, the company has faced heightened scrutiny from investors, regulators, and political opposition. Although Adani Group shares have largely recovered from the steep crash triggered by the Hindenburg report, this latest development has reignited concerns over transparency and regulatory compliance.

In a brief statement, the Adani Group denied any wrongdoing and reiterated its commitment to lawful cooperation with authorities in all jurisdictions.

“We categorically reject any insinuation of non-compliance. The Group operates within the parameters of law and maintains the highest standards of corporate governance,” the statement read.

The issue has also sparked political reactions in India, with opposition leaders demanding clarification from the government on why the summons has not been served. Critics argue that the incident raises questions about whether influential corporate figures are receiving preferential treatment.

On the markets front, shares of Adani Enterprises dipped slightly following the news, while other group companies saw minor fluctuations. Market analysts say investor sentiment could be affected if the legal standoff prolongs.

Read Also : Trump-Putin Summit at Risk: Russia Issues 72-Hour Warning Over Ukraine’s Deadly Missile & Drone Provocations